Berkshire Hathaway is a solid alternative to an ETF. It offers exposure to a portfolio of listed and unlisted companies. Indeed, Warren Buffett has signaled a preference to be hands off with their wholly owned subsidiaries. However, the Q3 earnings have been mixed. And, Berkshire is exposed to a broader economic slowdown.

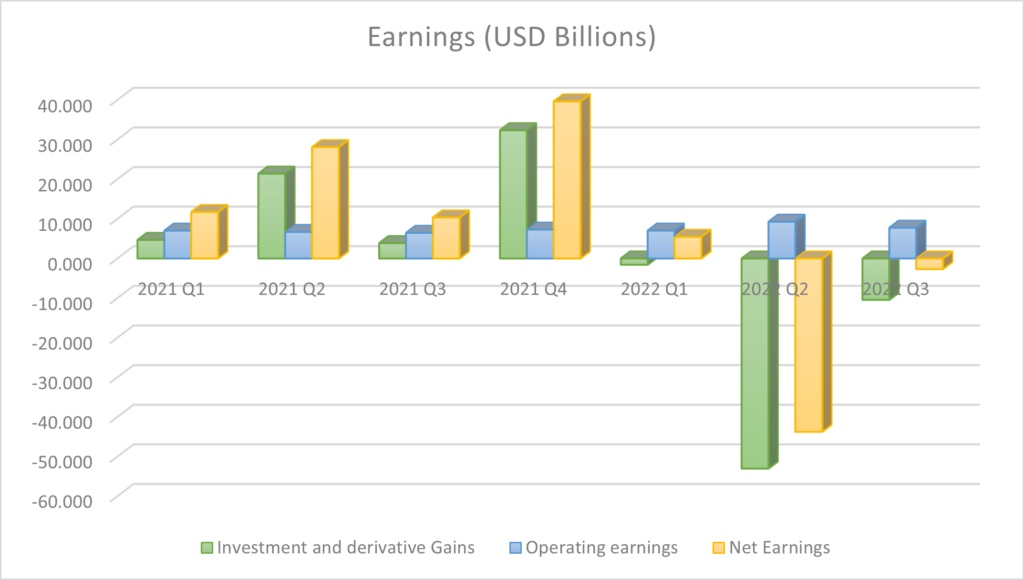

Berkshire Hathaway’s Q3 Earnings show why it could be a solid basis for a portfolio. In Q3, 2022, Operating Earnings grew 20% y/y. This is despite the impact of natural disasters on the insurance business and despite broader earnings declines across the S&P 500. Investment and derivative losses primarily explain the negative net earnings. These are unrealized losses. Any loss is sub-optimal. But, if an investor is to be exposed to the broader market, a loss during Q3 was likely.

| 2021 Q1 | 2021 Q2 | 2021 Q3 | 2021 Q4 | 2022 Q1 | 2022 Q2 | 2022 Q3 | |

| Investment and derivative Gains | 4.693 | 21.408 | 3.878 | 32.361 | -1.580 | -53.038 | -10.449 |

| Operating earnings | 7.018 | 6.686 | 6.466 | 7.285 | 7.040 | 9.283 | 7.761 |

| Net Earnings | 11.711 | 28.094 | 10.344 | 39.646 | 5.460 | -43.755 | -2.688 |

Berkshire Hathaway can also form the bedrock of a portfolio, around which investors might focus on their own ‘best bets’. Naturally, this assumes that investors wish to maintain market exposure given Berkshire Hathaway’s beta of around 0.9 and the looming market headwinds.

The operating performance

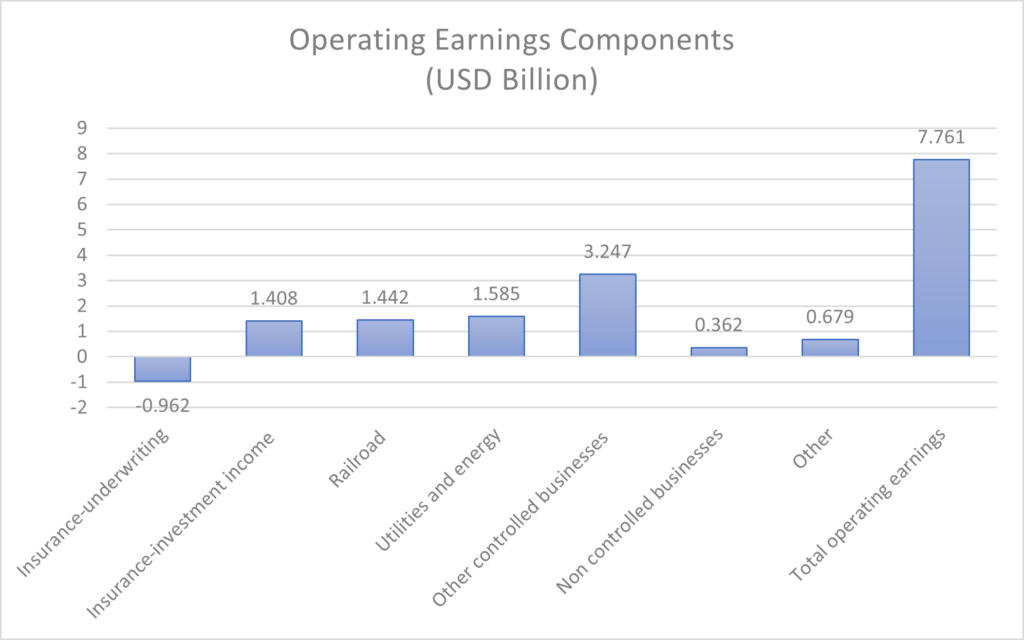

If we dig into the operating earnings, we see several key takeaways.

1: Operating earnings have steadily increased over the past 18 months. This is generally a good sign and suggests that the unlisted businesses are performing reasonably strongly.

2: In Q3, all operating sectors had positive earnings except for insurance. This could be a continued risk factor going forward given the impact of climate change on disaster risk. However, off-setting this is the rising insurance premiums attendant with such risk. Positive signs were in insurance investment income (i.e., due to the sheer cash buffer the company maintains generating interest revenue) and railroads, which generated positive earnings and headed off the threat of industrial action.

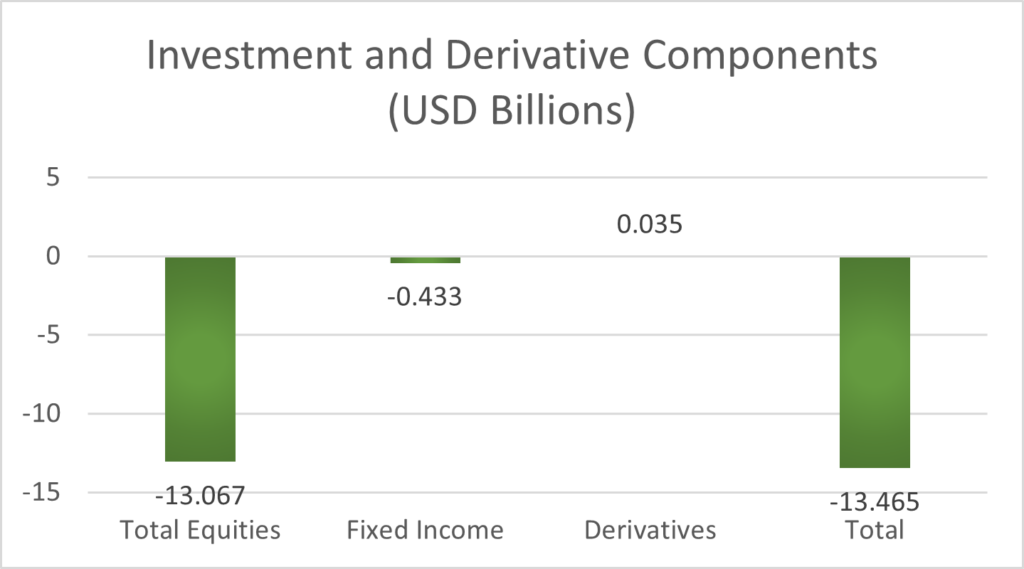

Investment performance

Berkshire Hathaway’s net earnings were weighed down by investment losses. These were primarily equities. However, there were some fixed income losses. This likely reflects a capital loss associated with rising interest rates. This is illustrated below. Note that the total losses reported below do not reflect the tax implications of those losses, which causes them to differ from the above reported investment loss. The losses are almost entirely unrealized.

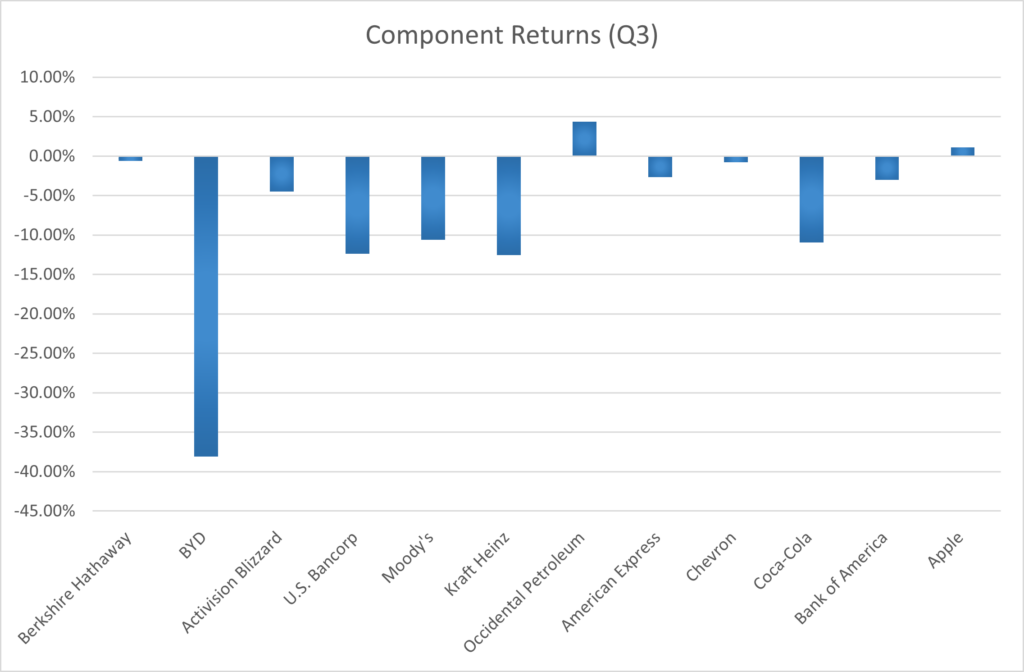

The below graph illustrates why the investment looses were so severe. It contains the Q3 returns for the largest 10 US listed stocks in Berkshire Hathaway’s portfolio, plus BYD (of which Berkshire Hathaway owns around 20%). Other than Occidental Petroleum and Apple, all components experienced negative returns. However, this is in line with the market performance during Q3. Notably, most of these names have had positive returns during Q4 thus far, suggesting a potential turn around.

What does the future hold?

Predicting the future for any company – including Berkshire Hathaway – is fraught. Given Berkshire Hathaway’s beta is around 0.9, it is significantly exposed to broader economic headwinds. This includes the impact of rising rates and slowing growth. There are some specific factors to consider in this context.

Treasury bills: Berkshire Hathaway owns around $76 billion in treasury bills. A higher rate environment will generate more interest income. While the prospect of higher rates could expose Berkshire Hathaway to capital losses, there is a strong income bedrock. T-bills are also a solid strategy if Berkshire Hathaway wishes to maintain dry powder for possible investments in stocks it perceives to be cheap.

Oil: Berkshire Hathaway’s strong focus on oil could bode well in the near term. There is limited oil supply coming to market, with OPEC+ signaling a desire to control supply to support prices. CAPEX has been relatively subdued in the sector. When China re-opens, which it is inevitable it will eventually do, oil demand will also increase. While macroeconomic headwinds could dampen demand, there is a natural floor to it.

Banks: The exposure to several financials (American Express, US Bancorp and Bank of America) creates some risks. Deal flow declining (impacting investment banking income). Further, lending activity has slowed given the high mortgage rates, and a recession could bring more bad debts. Further, government treasuries now pay significantly more than bank deposits, which would likely cause large depositors to shift from bank deposits to t-bills. This implicitly reduces the banks’ access to capital. The banking exposure does not seem a universal positive.

Overall then Berkshire Hathaway offers some bright spots. Berkshire Hathaway has shown strong operating management. In general, Berkshire Hathaway has performed well, especially compared with the market. Past performance is not a guarantee of future performance. However, it appears to be a solid ETF equivalent for those looking for market exposure.