BlockFi files for Bankruptcy

BlockFi has filed for Chapter 11 Bankruptcy protection.

The immediate catalyst is FTX’s collapse. This collapse creates both a liquidity and a potential solvency problem. It also halts FTX’s prior bailout plans for BlockFi. Thus, it was inevitable that BlockFi would fold.

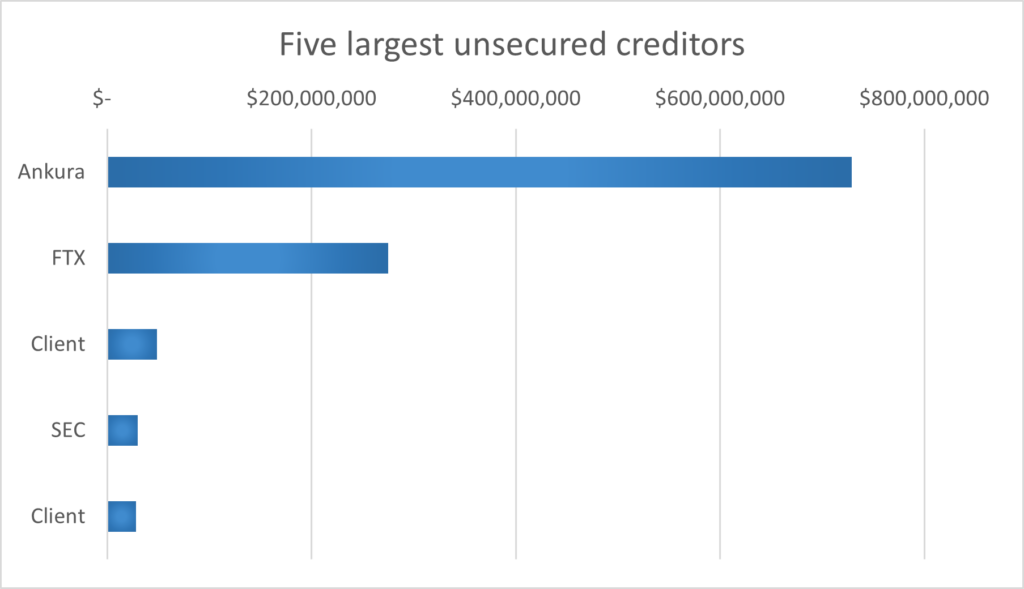

BlockFi’s creditors and investors stand to lose significant money. The bankruptcy filing indicates that they have over 100,000 creditors and liabilities are between $1 billion and $10 billion. The largest creditor is owed over $700 million. FTX is owed $275 million. The SEC is owed $30 million. More than 50 creditors are owed more than $1 million.

The core problem with BlockFi preceded FTX, however. BlockFi’s business model always had flaws. BlockFi functioned much like a bank, albeit with an additional exchange. The core of the business involved encouraging people to use the platform with promised interest rates of 7%+ on USD stablecoin deposits. BlockFi would then lend the money to risky borrowers. These reportedly include Alameda. When the borrowers fail, this creates a solvency problem for BlockFi. BlockFi’s risk level was ultimately a disaster waiting to happen.