What is a company or a stock worth?

How do you value a company? What are free cash flows? What is the cost of capital?

But how do you value a company?

There are many valuation techniques, and associated jargon, that valuation can look impenetrable. This course explains these terms of art and clarifies how to value companies.

This course is here to help: What will you learn?

- Discounted cash flow valuation techniques

- How to calculate cash flows

- What is the cost of capital, how to calculate it, and how to match it with cash flows

- How to determine the intrinsic value of a company and a stock

What you get

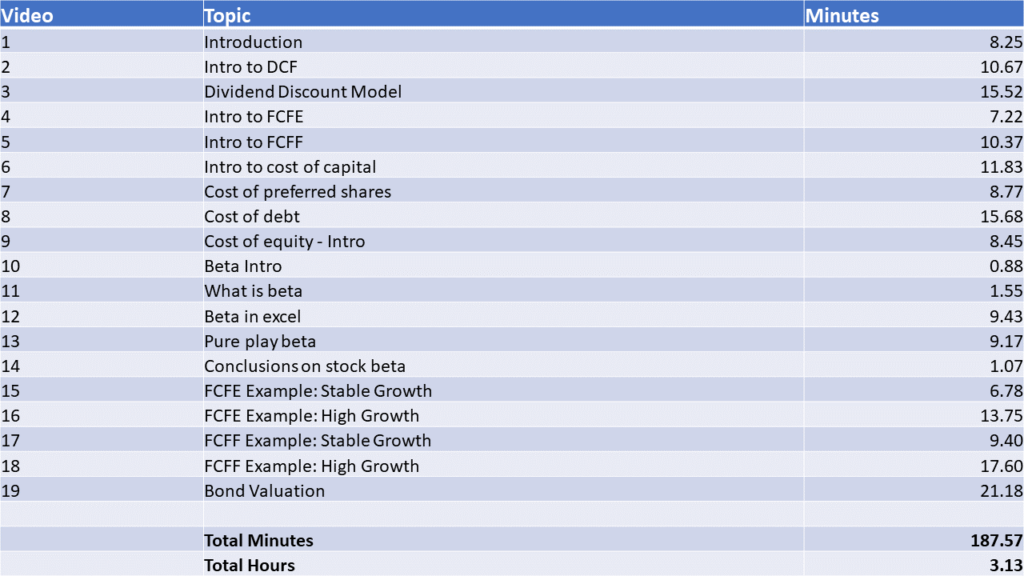

- 19 Video tutorial swith detailed explanations of all valuation concepts

- Worked examples in those tutorials

- Over 3 hours of video content