Crypto’s biggest losers in a horrible year for cryptocurrency

It has been a shockingly bad year for crypto. During 2022, Bitcoin fell 65% and Ethereum fell 68%. And myriad smaller coins have suffered similar fates. Shiba and Doge have both fallen precipitously. And, other poop coins went to zero.

There have also been innocent victims. People who were duped by complex stable coins, which turned out not to be stable (i.e., Terra, which has now cratered). Crypto hedge funds, such as Three Arrows Capital (3AC) collapsed, partly due to the Terra collapse. As did sham funds, such as Alameda Research. 3AC’s collapse in turn impacted Voyager, which Binance subsequently bought.

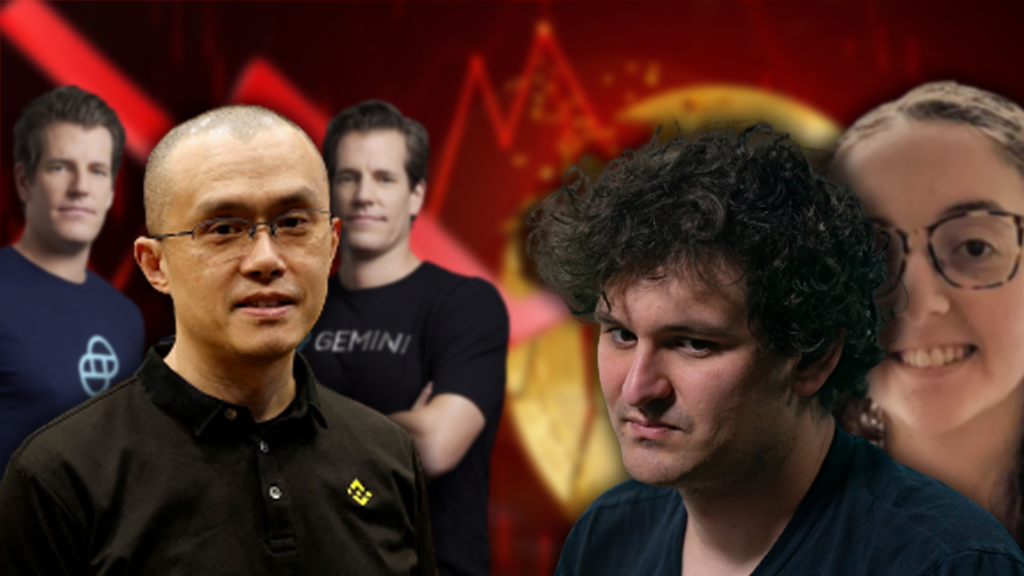

The collapse of Alameda Research – and FTX – had further implications. Both FTX and Alameda collapsed due to widespread fraud. Alameda’s former CEO (Caroline Ellison) and FTX’s co-founder (Gary Wang) have admitted to this fraud. Caroline Ellison further revealed poor risk management practices, misuse of customer funds, and fraud in her plea agreement.

FTX’s collapse subsequently brought down BlockFi, which FTX was going to bail out. It has triggered a liquidity crunch as Genesis. This in turn has also severely impacted Gemini via its exposure to Genesis.

FTX has also impacted smaller exchanges: Digital Surge, for example, has suffered due to FTX’s collapse. However, they have proposed an interesting recovery plan that would keep the exchange operating and profits used to pay back customers.

Binance has tried to reassure customers by providing a proof of reserves. However, this did not satisfy the market due to it necessarily being in complete and not capturing Binance’s liability position or the nature of possible margin positions. Subsequently, Mazars – the auditing firm involved in undertaking the proof of reserves – dropped crypto clients.

This has resulted in a bad year for crypto. Forbes subsequently reported some of the biggest losers. It covers every major investor, especially those tied to struggling exchanges. The biggest losers – percentage wise – are of course Sam Bankman Fried and Gary Wang. However, even CZ – who runs the largest cryptocurrency exchange – has seen his net worth fall 93%.

Unfortunately, many retail investors and innocent by standards have suffered in 2022. The fraud at FTX has cost customers billions.

What then does the next year bring for crypto? 2023 looks destined to bring more pain for the crypto market. The FTX contagion is still on going. Many other parties had cryptocurrency tied to FTX. And, these customers might be in limbo as they wait to recover their assets. Contagion can take a long time to work its way through the markets, creating significant risk in the crypto space in the near future.