Michael Burry has said that he was “wrong” to say “sell” in February 2023. Of course, after he tweeted “Sell”, the market surged and then did a round trip. In hindsight, that was indeed wrong. But, aside, from what materialized in hindsight, what else might be behind his admission?

Michael Burry’s tweets are often opaque. However, it is worth exploring what his thought process might be to see whether we can draw new insights about what is happening in financial markets.

Unusual trading behavior

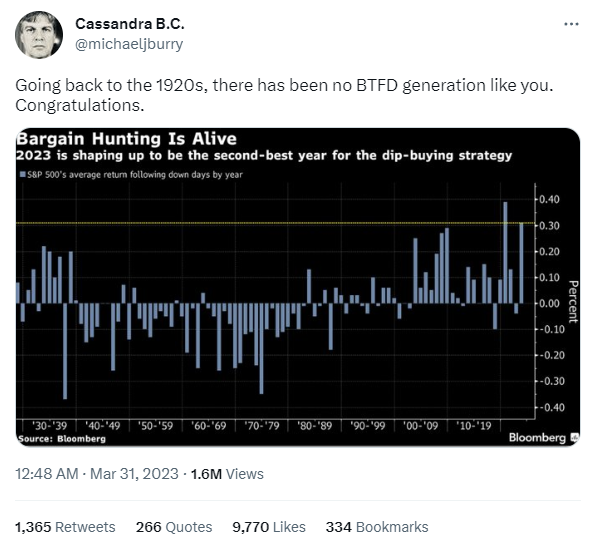

It is quite possible that Michael Burry is merely pointing out unusual trading behavior. Michael Burry might contemporaneously tweeted a chart that looks at average returns after a ‘down’ trading day over time. He has noted a distinct ‘buy the dip’ trend in recent years. This suggests that the market might currently feature significant behavioral biases. Thus, even if he believes that the market should decline, it is difficult to time this and the market could remain ‘wrong’ for some time.

Change in fundamentals

Michael Burry might also believe that market fundamentals are less bad. This is because he had previously flagged a recession risk owing (inter alia) to The Federal Reserve raising interest rates. This implies that if an event deters the fed from hiking rates and that event is not recessionary, it might be good news for markets.

This is where the banking crisis comes in. The banking crisis has seemingly deterred The Fed from hiking rates by as much. However, Michael Burry has stated that he does not see “true danger” with the banking crisis, especially following its resolution. Further, treasury yields appear to have fallen significantly and potentially by more than the tightening caused by the banking crisis.

The net result of the Banking Crisis might ultimately be positive then: it might not itself be recessionary but it might deter The Fed from excess hiking. And, this might make Michael Burry less bearish about financial markets.

All of this is speculation, however. Michael Burry’s tweets are usually cryptic and opaque. And, new supervening events can always render commentary out of date as soon as it is published.