Simply Wall St Review

What companies should you invest in? How much should you pay? Answering these questions is easier said than done. Simply Wall St aims to make those decisions easier.

I subscribe to Simply Wall St and have used to evaluate myriad companies. In short, I have found it extremely useful. It has enabled me to make better informed investment decisions and I am satisfied with my subscription.

What is Simply Wall St?

Simply Wall St is an investment information platform. It contains information on firms’ fundamental information, analyst forecasts, and estimates of the firms’ value.

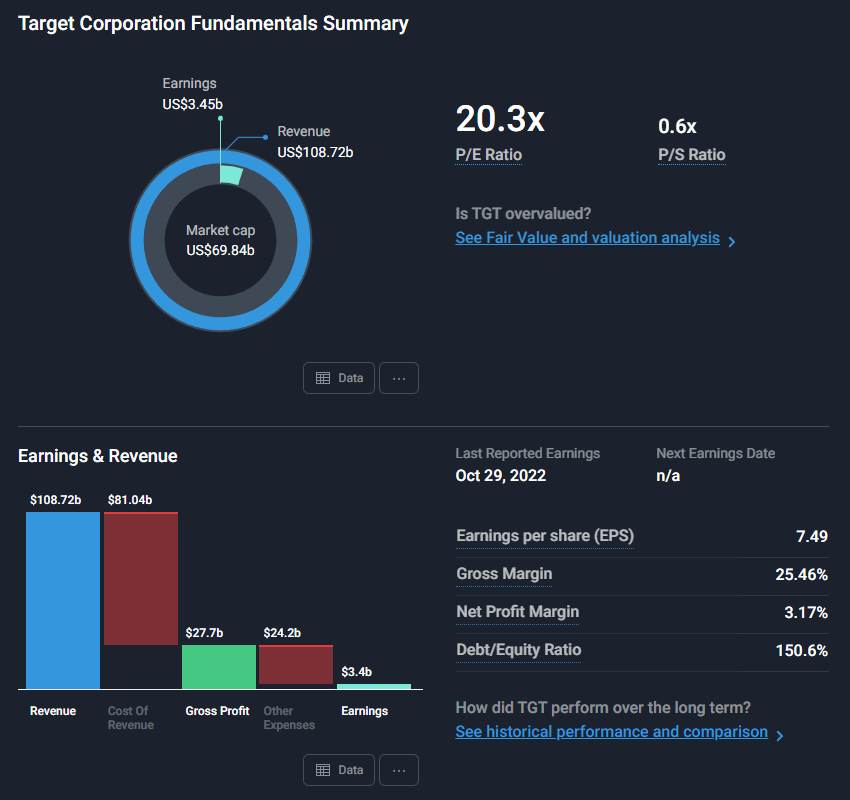

Fundamentals: Simply Wall St aims to simplify stock analysis. Thus, it does not report a full balance sheet, income statement, or cash flow statement. Rather, they present key figures, such as a waterflow chart of firms’ earnings and revenues.

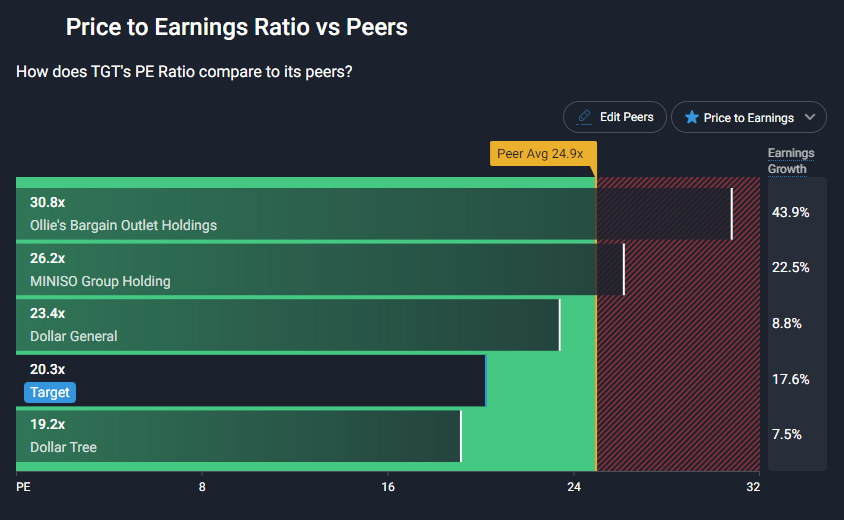

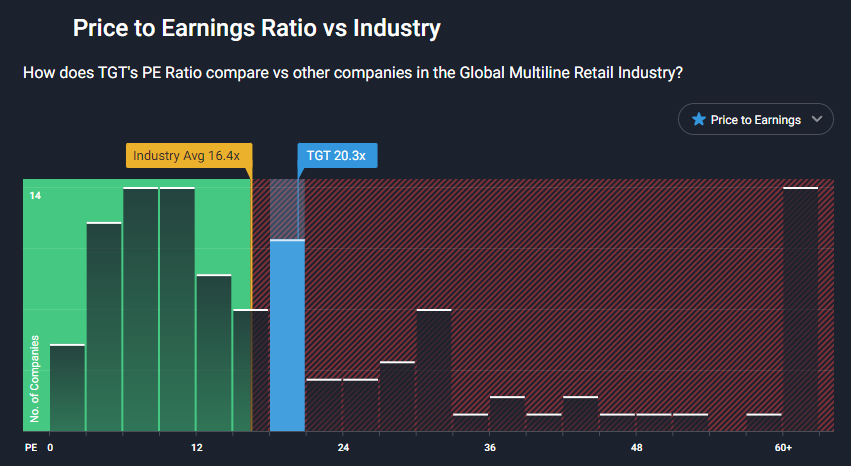

Valuation multiples: Simply Wall St provides information on firms’ valuation multiples. They provide relevant multiples based on the firms’ operations and industry. Simply Wall St also provides peer firms. This includes comparing the focal firm’s multiples to direct competitors and to other firms in the industry. The goal is to determine – at a glance – whether the firm appears fairly valued.

Fundamental valuation and analyst forecasts: Simply Wall St has several approaches to firms’ fundamental values.

- Analyst price targets. The accuracy – or lack thereof- of these forecasts depends on how many analysts there are and the quality of those analysts.

- Automated valuation: Simply Wall St provides an automated valuation that uses discounted cash flow formulae and analyst inputs. This provides a guide for the firm’s potential value. Simply Wall St provides the inputs they use. Thus, while the automated valuation is likely inaccurate, it provides a starting point to analyze what the firm might be worth.

- Valuator tool: This tool enables one to alter the inputs going into the automated valuation. In so doing, it enables people to see whether the valuation is sensitive to assumptions. This is helpful if you disagree with the inputs that Simply Wall St uses.

How useful is Simply Wall St?

The issue is then whether Simply Wall St provides a valuable offering. The short answer is yes. However, the value is lower you have access to Factset or Bloomberg. Simply Wall St’s main use comes from enabling investors to identify appropriately valued companies; and thus, investing opportunities.

Simply Wall St provides a simply at-a-glance overview of companies’ relative valuations. It enables investors to quickly identify how companies compare with peer firms. This is useful. The main advantage is that it indicates whether a firm might be overvalued. However, the main disadvantage is that comparing firms’ multiples can be simplistic. For example, firms might have different P/E multiples due to different growth rates. Thus, it is essential to analyze firms’ multiples in context.

Simply Wall St also provides analyst price forecasts. Analysts’ price predictions are extremely useful when trying to determine what to invest in. Thus, Simply Wall St provides useful data. However, the disadvantage is that they do not provide analysts’ reports and it is not always clear how timely the forecasts are. Thus, it is important to be circumspect when analyzing the data.

The aforementioned data is sometimes available from online sources. However, Simply Wall St takes the time and work out of obtaining all the data manually. In so doing, it can significantly simplify the valuation process.

Simply Wall St’s valuator tool is useful. However, has some caveats. Simply Wall St’s automated valuation has some issues: it often does not align with analysts’ estimated valuations. And, it would be risky to rely on the valuation at face value. However, it is useful otherwise. Simply Wall St states how they value the company, the inputs used, and the assumptions made. They also state how many analysts they use to make an estimate. This enables investors to adjust the inputs and use Simply Wall St’s valuation as a starting point.

Simply Wall St further provides useful tables of which firms appear to be under priced or overpriced. It would be risky to rely on these without further analysis. However, it is a useful starting point to identify investing ideas. In so doing, Simply Wall St can save investors significant time.

Overall thoughts

Simply Wall St is good value. The platform contains significant information about firms’ analyst forecasts, price targets, and fundamental information. This places investors in a better position to make more informed investment decisions. I am satisfied with my personal subscription and would renew.