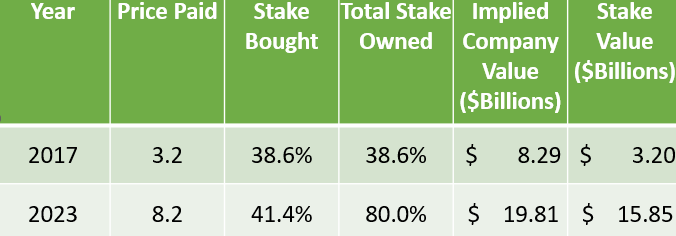

Warren Buffet and Berkshire Hathaway have revealed a significant investment in transport infrastructure. They have spent $8.2 Billion to acquire another 40.4% of Pilot Flying J. This is in addition to the 38.6% that they acquired in 2017 for $3.2 Billion. Berkshire Hathaway now owns 80% of Pilot Flying J and the acquisition values the company at $19.8 Billion.

Pilot Flying J is one of the largest ‘travel center’ operates in the US. It operates truck stops and gas stations in 44 US states and six Canadian provinces. It has over 650 such centers. They have also indicated partnerships and agreements with GM and Volvo to expand EV charging.

This is a sizeable bet on transport infrastructure and raises the question of why Berkshire Hathaway much a large investment.

There are likely several reasons for investing so heavily in transport infrastructure, and Pilot Flying J specifically.

- Management Team: Berkshire Hathaway has emphasized the importance of a quality management team. Pilot Flying J’s team appears set to continue and Jimmy Haslam appears set to remain involved.

- Inflation and economic issues: Transport infrastructure provides some resistance in challenging economic times. While travel might decline in a recession, there is always a baseload level of necessary transport. Further, while oil prices can fluctuate significantly, gas stations’ margins can increase with inflation.

- Future plans: Pilot Flying J has indicated that it will expand into EV charging. This offers some growth opportunities if they can obtain significant market share. It also shows a clear strategy to mitigate reductions in internal combustion fleets.

- Market position: Pilot Flying J has a relatively strong market position. According to Berkshire Hathaway’s 10k filing, Pilot’s top 15 diesel customer account for less than 15% of Pilot Flying J’s sales, and the top 10 suppliers account for less than 50% of the fuel purchases. Further, they are a relatively large ‘travel center’, placing them in a strong competitive position.

- Stable infrastructure like earnings: Warren Buffett’s letter to shareholders highlights a desire for quality earnings coupled with capital growth. The combination of solid earnings at Pilot Flying J has resonances of dividend paying companies. Further, the EV related strategy suggests future capital growth prospects.

These factors likely explain Warren Buffett’s and Berkshire Hathaway’s interest in Pilot Flying J.