Warren Buffett buys $4bn TSMC

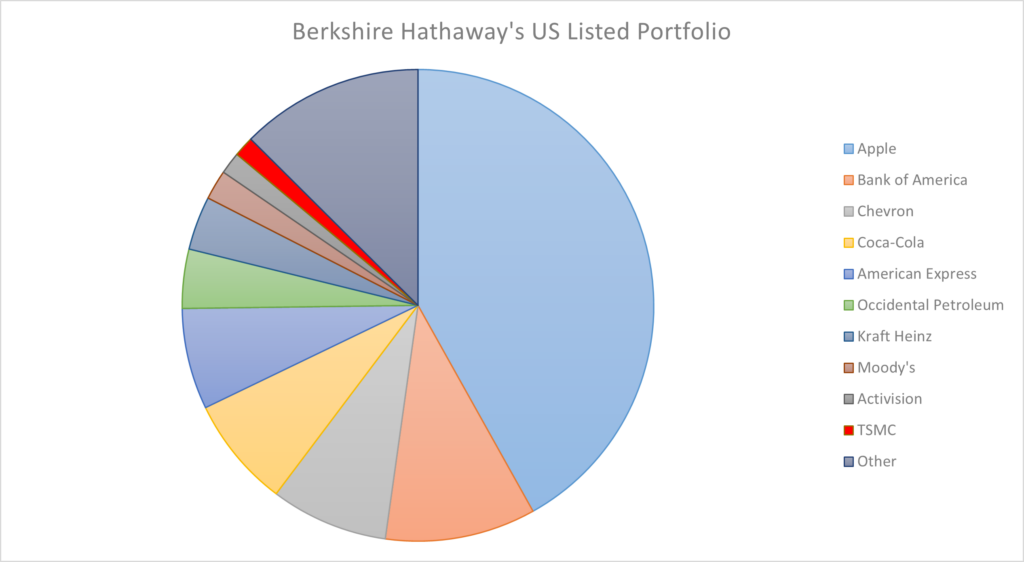

Warren Buffett’s Berkshire Hathaway (BRK) has revealed a $4 billion purchase into TSMC (Taiwan Semiconductor). BRK purchased TSMC’s American Depository Receipts (ADRs). These represent an exposure to TSMC’s primary listing, albeit denominated in USD.

TSMC is now BRK’s 10th largest US listed holding accounting for around 1.3% of BRK’s US listed portfolio. BRK has generally not invested in ‘tech’ firms per se (in general). This begs the question of why BRK would want to invest in TSMC.

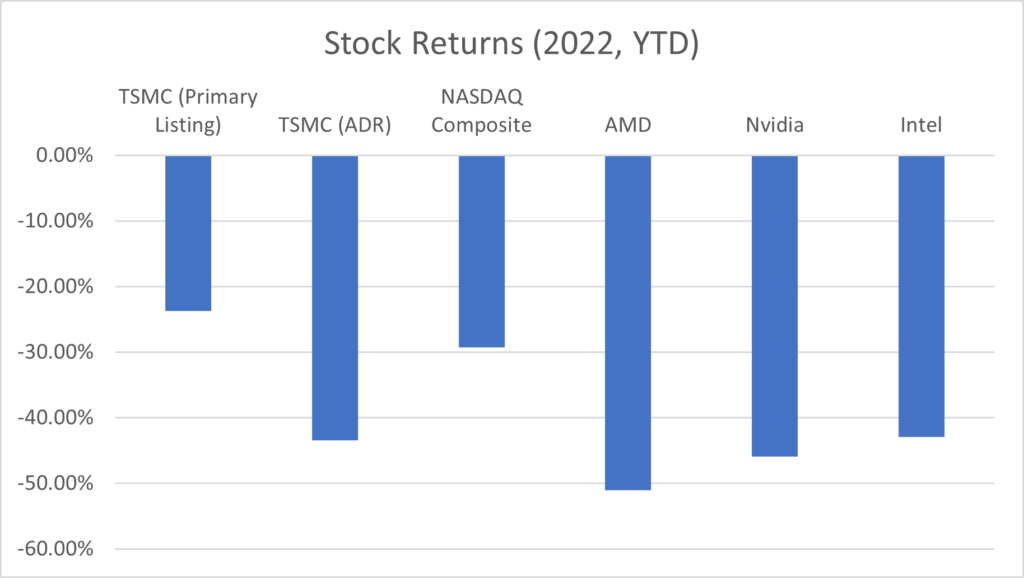

Stock Returns:

The historical stock returns have not been brilliant. TSMC’s primary listing is down more than 20%. The ADR is down more than 40%, reflecting the strong USD. However, the NASDAQ Composite is down 29%, and Nvidia, AMD, and Intel are all down more than 40%. Thus, while the stock returns are not strong, if the TW$ stops depreciating as rapidly against the USD, returns could be more attractive in the future.

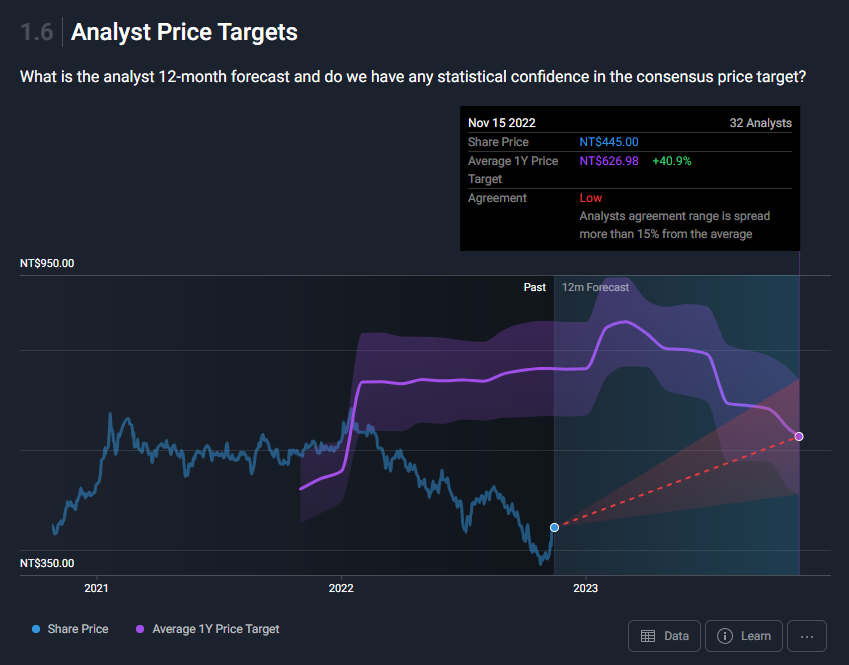

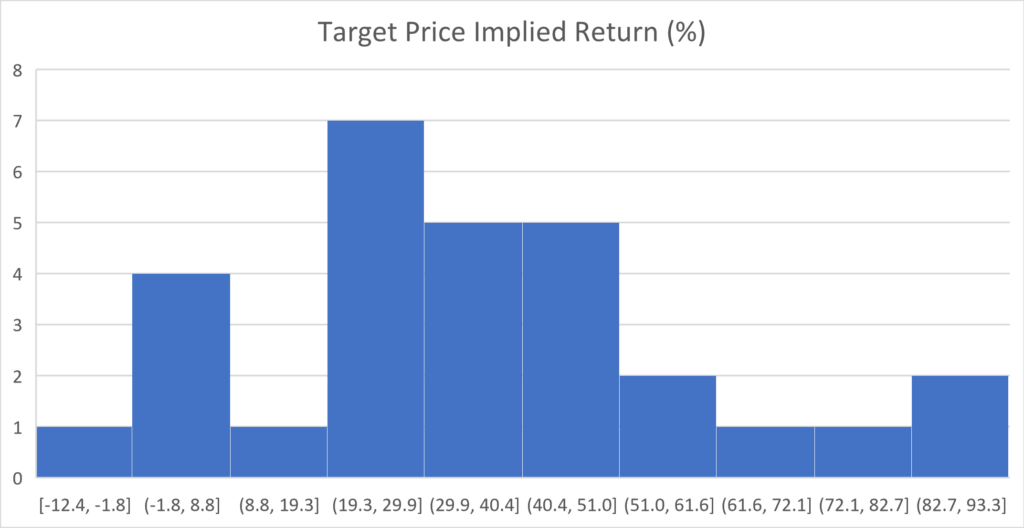

Analysts:

TSMC has several key positives. According to Simply Wall Street, analysts give TSMC a 40% upside for the primary listing. While this is denominated in Taiwanese dollars and connotes foreign exchange risk, it suggests that there is earnings upside.

Analysts in Factset give a similar upside, of around 33%. In Factset, 95% of analysts have TSMC as a buy, 5% as a hold, and no analysts as a sell. Investors should not blindly rely on analysts’ forecasts. However, this does suggest positive sentiment. The median target price is TW$ 595.

Earnings growth:

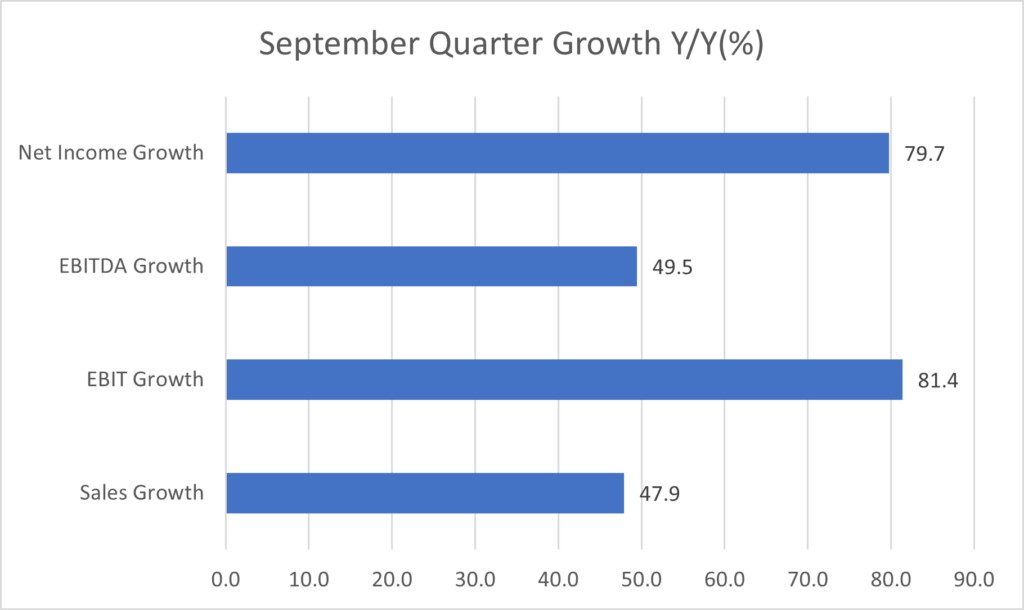

TSMC has experienced strong historical earnings growth. Historical performance does not per se imply future performance. However, it implies that TSMC has quality earnings and is not a revenue/growth focused tech company. Indeed, Net income has grown nearly 80% over the past year. This is not an isolated quarter. TSMC has grown steadily. This does not per se imply that future growth will be strong. However, it sends a positive signal about TSMC’s management quality.

Strategic positioning:

The semiconductor industry has faced geopolitical pressure. The Biden administration has banned the sale of certain semiconductors to China. This has harmed the impacted companies and there is some extraterritorial effect. Buffett/ Berkshire likely are assuming that the situation either (a) is fully priced in, and/or (b) will resolve, and/or (c) the market has been excessively pessimistic. Given that Berkshire has a sizeable holding in BYD, they would appear to believe that geopolitical issues will likely be resolved.

What then does this mean for TSMC: Whether investors follow Berkshire should depend on the investors’ own views about the stock. Investors should not blindly follow other investors. However, BRK’s sizeable position does reflect strongly on the company and is a signal of confidence.