Will the US enter recession in 2023

If you as five economists for a forecast, you will get ten different answers. And, this is much the same when predicting whether there will be a recession in 2023. Nevertheless, I shall add yet another opinion to the cacophony.

What are CEOs saying?

We can start with what CEOs are saying about the economy. On the one hand, CEOs are at the proverbial coal face. They directly witness consumer behavior. Thus, they should know the state of the economy. Here, we have several surveys:

- KPMG: KPMG surveyed 1300 CEOs, 400 of whom are in the US. These are CEOs of “large” corporations. They reported the results in early October. Here, 91% of CEOs expect a recession in 2023. Only 34% of US based CEOs think it will be mild or short.

- Conference Board: The Conference Board is most known for reporting leading economic indicators and for their CEO confidence survey. In their Q4 survey (published on 20 October 2022), 98% of CEOs are ‘preparing for a recession’ in the US in 12-18 months (and 99% in the EU). Further, in the first three quarters of 2022, only 19% of CEOs experienced an increase in demand whereas 59% reported an increase in input costs. That figure is likely even higher if we adjust for companies adjusting out expensive inputs for cheaper ones.

The CEO surveys are interesting. However, they are not decisive. CEOs might have a vested interest in being negative. First, in a bear market, CEOs would want to avoid sounding too confident lest they be accused of issuing falsely positive statements, thereby enlivening SEC Rule 10b-5. Second, CEOs might have an incentive to take a ‘big bath’ on economic forecasts now – when there is general pessimism – in order to potentially look like they are overperforming in the future.

Economists’ forecasts

Economic forecasts are fraught. However, they indicate that a recession is more likely than not. According to Bloomberg, economists see a 70% chance of a recession in the US in 2023. The probability of a recession has increased month-on-month from 50% to 60% and then to 70%. Bloomberg’s own economic model (cf. survey of economists) puts the probability of a recession at 100%.

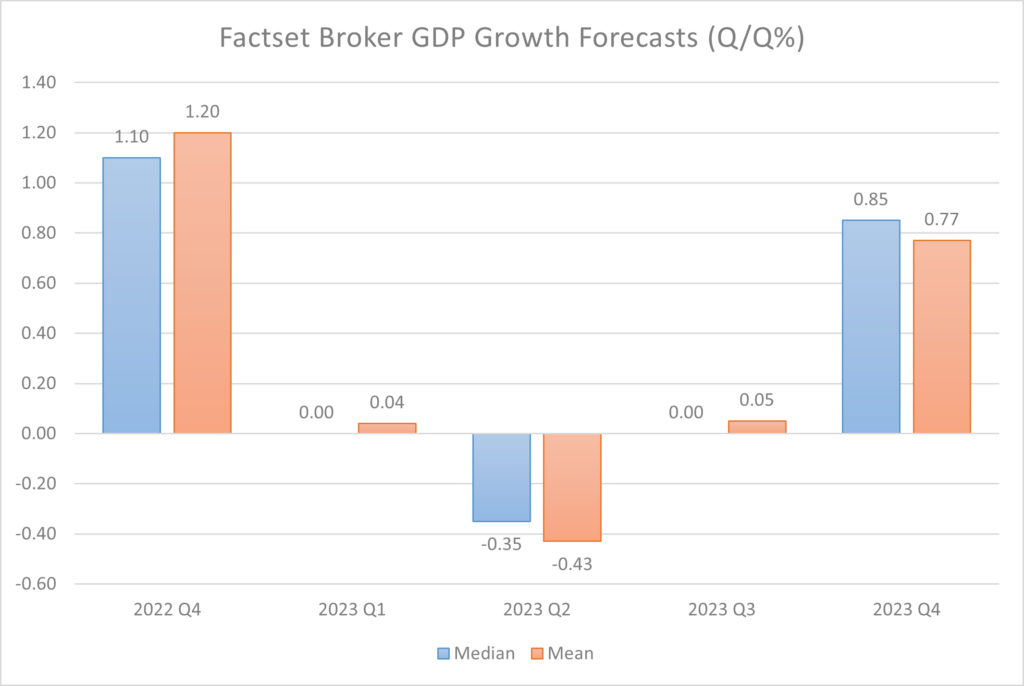

Factset also reports similar sentiments for GDP growth forecasts. Here, Factset reports analysts’ economic forecasts and indicates that growth in Q1-Q3 is expected to be near zero or negative. However, growth might be positive in 2023 Q4. It is important to not over-emphasize such forecasts. Long-dated forecasts can be notoriously inaccurate.

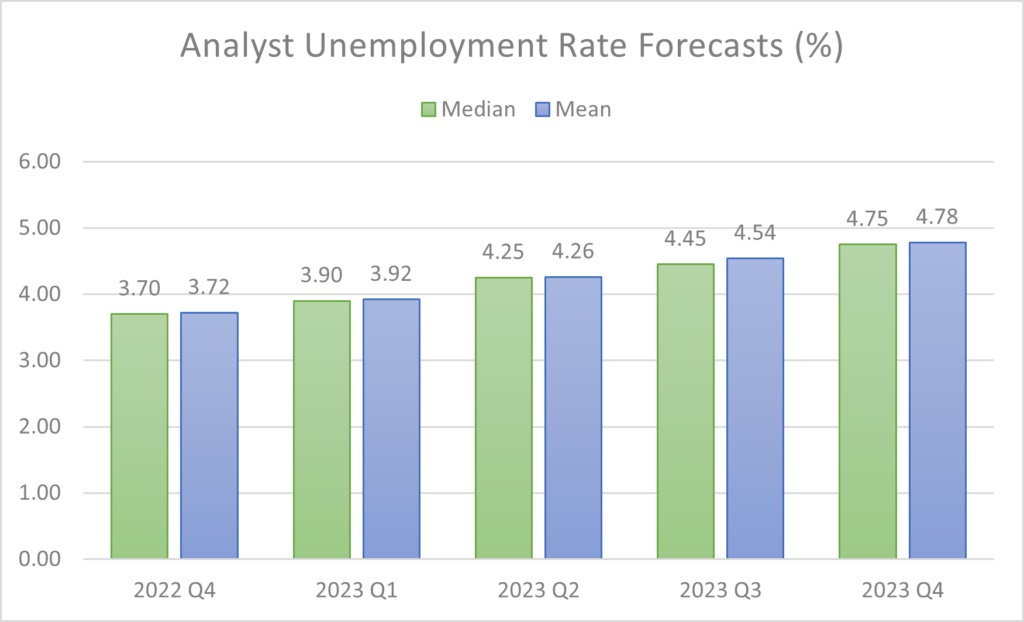

It is also important to consider unemployment. The US had two quarters of negative GDP growth in 2022. However, the NBER did not declare a recession. The argued reason for this is that unemployment was low and a recession is unlikely without significant unemployment. However, here, Factset economists predict a significant increase in the unemployment rate from the 3.7% recorded in November 2022.

The rise in unemployment coupled with the significant worsening in real GDP growth and stubborn inflation suggests that a recession is a strong possibility in 2023. Or, if not a recession, near zero economic growth appears likely.

The Yield Curve

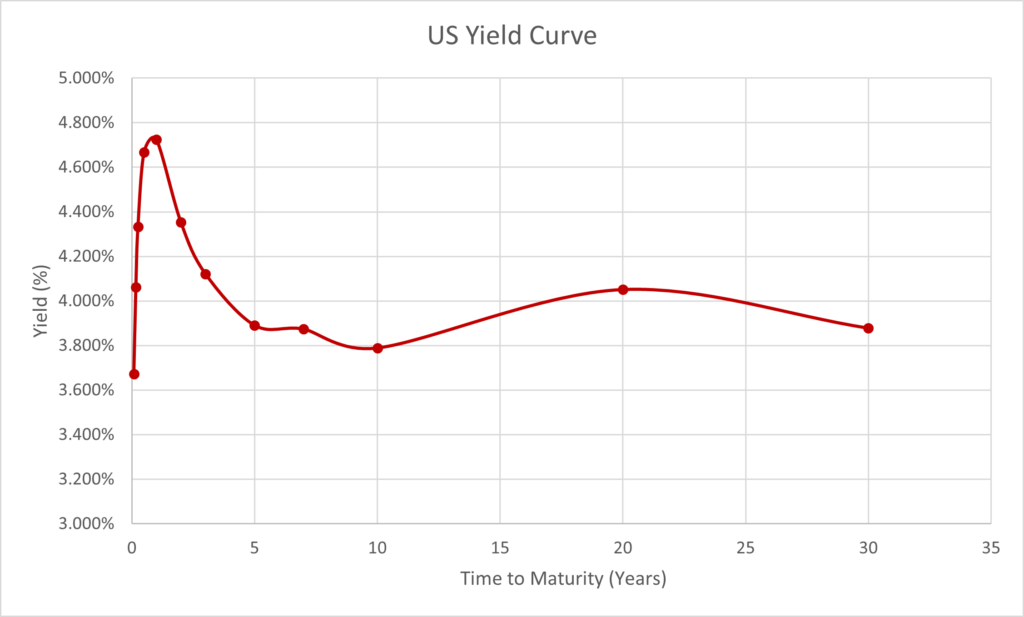

The yield curve can provide insight into what the market thinks will happen to the economy. An inverted yield curve is where the annual yield on long dated treasuries is lower than that on short dated treasuries. Yield curve inversion implies that the Federal Reserve would need to cut rates in the future. And, a rate cut can reflect a recession.

The US Yield curve is significantly inverted. The 2-year yield is 56.5bps higher than the 10-year yield. This suggests that the market is pricing in significant rate cuts. The 2-year yield is also significantly higher than that of the 3,5, and 7 year yields. Thus, the yield curve suggests a strong recession possibility.

Corporate earnings

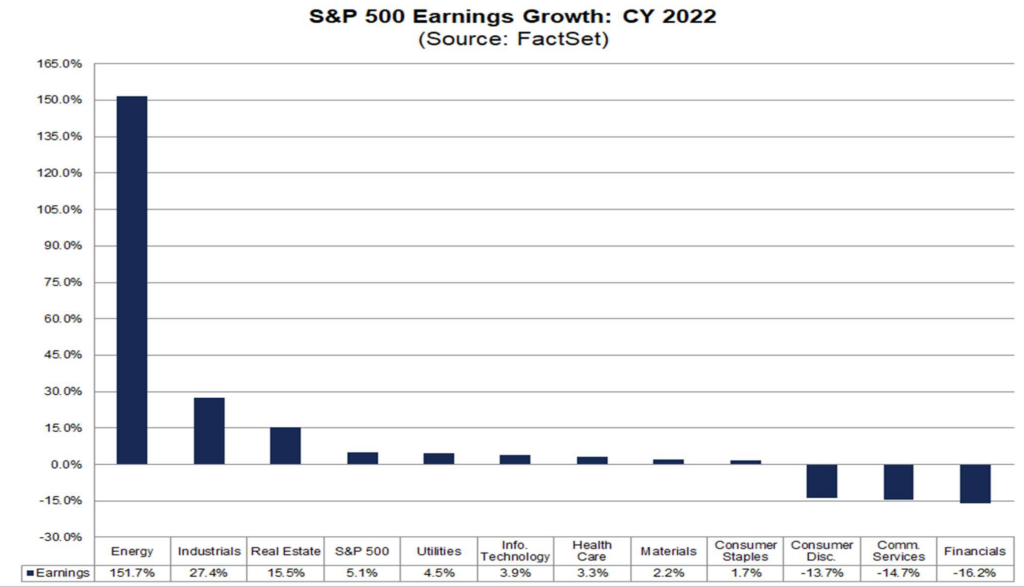

Corporate earnings are not looking positive. In 2022, energy companies were the only sector to experience strong earnings growth. Indeed, consumer discretionary, financials, and commercial services experienced negative earnings growth (based on CY 2022 estimates).

Factset indicates that analysts expect CY22 earnings growth to come in at 5.1%. This is well below inflation. It is also lower than the forecast issued in June 2022, suggesting worsening economic conditions.

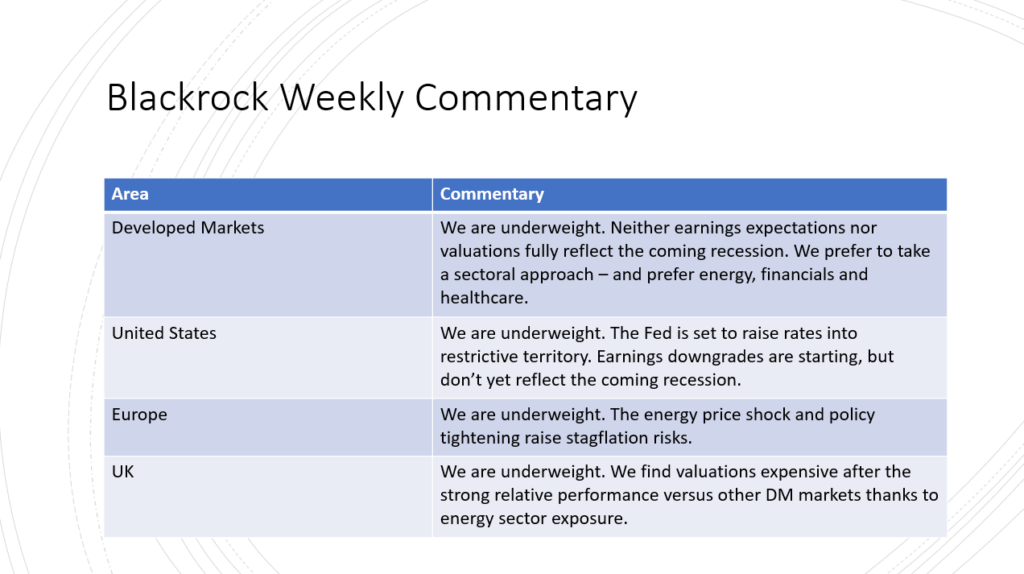

Blackrock also indicates that the market has not yet fully priced in worsening earnings, earnings could decline further, an the Federal Reserve is likely to exacerbate this by keeping interest rates too high into an economic downturn.

Interesting, Elon Musk and Cathie Wood have expressed similar sentiments. However, their corporate and investment performance suggest caution when taking them at face value. Michael Burry has also suggested similarly, albeit in a since deleted tweet.

What then does this mean for the US economy?

Does all this mean that the US will enter a recession in 2023? It is not conclusive proof. CEOs, economists, and the bond market are pessimistic. Growth forecasts appear to be low. This reflects the belief that interest rates will crush demand, inflation will nevertheless remain high, and unemployment will increase.

The US market faces strong headwinds in 2023 even if the US does not per se enter a recession. And, this suggests caution and appropriate risk management are necessary if investing during 2023. Investors might approach this by looking for pockets of genuine value, deploying derivatives, or simply looking for fixed income in creditworthy companies.