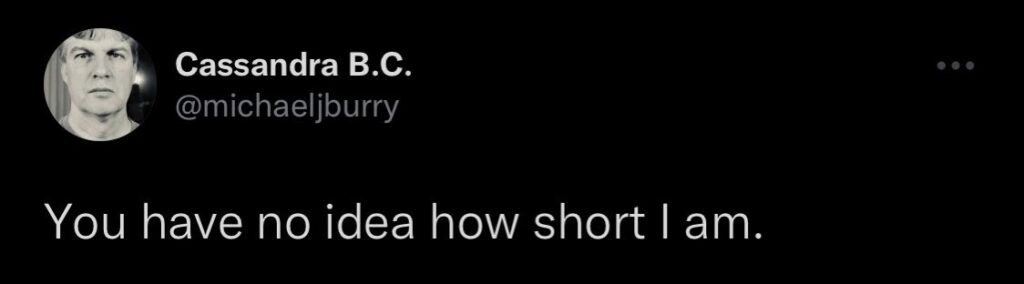

“You have no idea how short I am” ~ Michael Burry

“You have no idea how short I am”: so says permabear Michael Burry. Indeed, this is technically accurate. Michael Burry’s recent 13F filing did not (and need not) reveal short positions. However, it also did not disclose any put holdings, which would otherwise appear in the 13F.

The question is whether and why Michael Burry might in fact be short. And, it would be unsurprising if he is. Michael Burry is in the habit of deleting his tweets. However, myriad tweet archives exist.

Michael Burry’s archived tweets are telling. Michael Burry has warned about ‘earnings compression’ (i.e., earnings declining in addition to valuations falling). He has warned about layoffs. He has argued that the Federal Reserve might over-tighten, risking a deeper recession. Michael Burry has also noted that past market movements suggest that the market has further to fall.

Michael Burry is not alone in his pessimism. BlackRock has echoed these concerns. On 14 November 2022, BlackRock stated “Surging stocks show markets believe hopes of a soft landing by the Fed to be true. We disagree and stay underweight developed market (DM) stocks […] sticky core inflation keeps the Fed on track to overtighten.”

This all suggests that Michael Burry could indeed be short. This might be operationalized via either a straight short position (or CFDs or futures) or put options on the market index. This would be consistent with Michael Burry’s tweets throughout 2022. It would also be unsurprising given that he was making these tweets when the S&P 500 was around 3600 while proclaiming “You have no idea how short I am” when the S&P 500 was around 4000.

This all suggests a potential short position in Michael Burry’s portfolio. But, there is still much we do not know, including the size of that position and its form.